Table of Contents

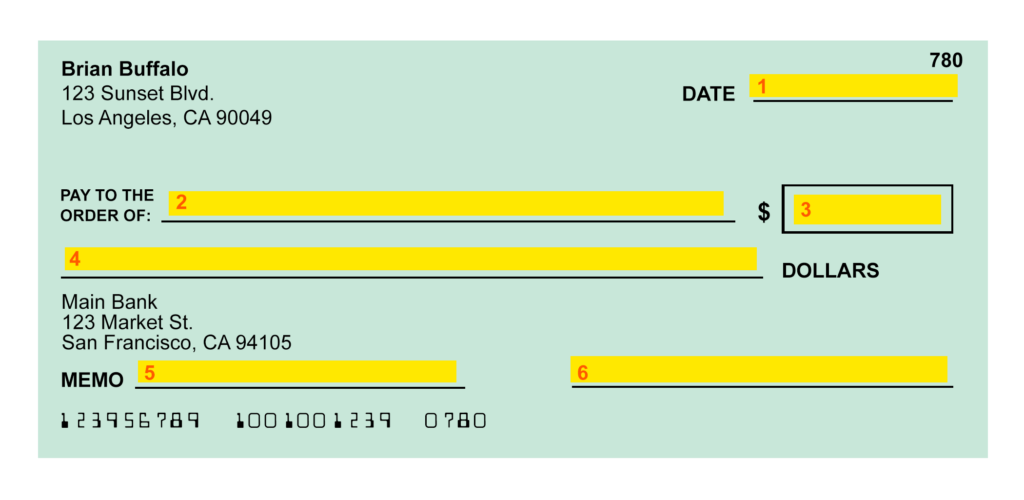

ToggleStep 1: Date the Check

Start by writing the current date in the top right corner of the check. Use the format MM/DD/YYYY (e.g., 12/30/2024) or write the date out in full, such as December 30, 2024. The date is important for record-keeping and ensures the check is valid.

Step 2: Write the Payee Name

On the “Pay to the Order of” line, write the full name of the person or organization receiving the payment. For example:

- If you’re paying John Smith, write “John Smith.”

- If it’s for a company like ABC Electric, ensure the company name is spelled correctly.

Step 3: Fill in the Numeric Amount

In the box with the dollar sign ($), write the exact amount you wish to pay in numbers. For $2,640, write “2640.00.” Be clear and precise to avoid misunderstandings or tampering.

Step 4: Spell Out the Amount in Words

On the line below the payee, spell out the payment amount in words. For $2,640, write:

“Two thousand six hundred forty dollars and 00/100.” This step ensures the amount is clear and cannot be altered. Include “and 00/100” to specify there are no cents.

Step 5: Add a Memo (Optional)

The memo line is optional but useful. It helps clarify the purpose of the check. For instance, write “December Rent” or “Invoice #12345.” Adding a memo is particularly helpful for personal or business records.

Step 6: Sign the Check

Finally, sign your name on the signature line in the bottom right corner. Use the same signature on file with your bank to validate the check. Without a signature, the check is invalid.

Common Mistakes to Avoid When Writing a Check

Incorrect Payee Names

Always double-check the spelling of the recipient’s name. Errors can cause delays or rejection of the check.

Mismatched Amounts

Ensure the numeric and written amounts match exactly. Any discrepancies may result in the check being returned.

Forgetting to Sign

An unsigned check is invalid and will not be processed by the bank. Always double-check this step before handing over the check.

How to Correct Errors on a Check

Minor Corrections

If you spot a minor error, such as a small typo, you can correct it by drawing a single line through the mistake and initialing next to the correction. However, this may not always be acceptable.

When to Void a Check

For significant mistakes, it’s best to void the check. Write “VOID” across the front and keep it for your records. Then, write a new check to ensure clarity.

Why Accuracy Matters

Financial Security

Accurate checks help prevent fraud and errors, ensuring your money goes to the right place.

Legal Considerations

A check is a legally binding document. Mistakes can lead to disputes or delays, so accuracy is crucial.

Alternatives to Writing Checks

Digital Payment Methods

Apps like Venmo, PayPal, and Zelle allow for quick and secure transfers. These options are convenient but may not replace checks for certain transactions.

Bank Transfers

Direct bank transfers are another secure method, particularly for large payments.

FAQs About Writing Checks

1. What should I do if I make a mistake on a check?

For small errors, draw a single line through the mistake and initial it. For major errors, void the check and write a new one.

2. Can I write a check for an odd amount like $2,640?

Yes, you can write checks for any amount, as long as you have sufficient funds in your account.

3. How do I void a check?

Write “VOID” across the front of the check and keep it for your records. Do not discard it until you’re sure it’s no longer needed.

4. Can I post-date a check?

You can post-date a check, but the bank may process it immediately if presented before the date.

5. What happens if I forget to write a memo?

The memo is optional and doesn’t affect the check’s validity, but it helps clarify the payment’s purpose.

6. Is there a limit on the amount I can write on a check?

Your bank may have a maximum limit for checks, but generally, you can write checks for any amount within your account’s balance.

Conclusion

Writing a check for $2,640 is straightforward when you follow the steps outlined above. Accuracy and attention to detail are essential to ensure your check is valid and processed smoothly. While checks may seem old-fashioned, they remain a secure and effective payment method for many situations. With this guide, you can write checks confidently and avoid common pitfalls.