Table of Contents

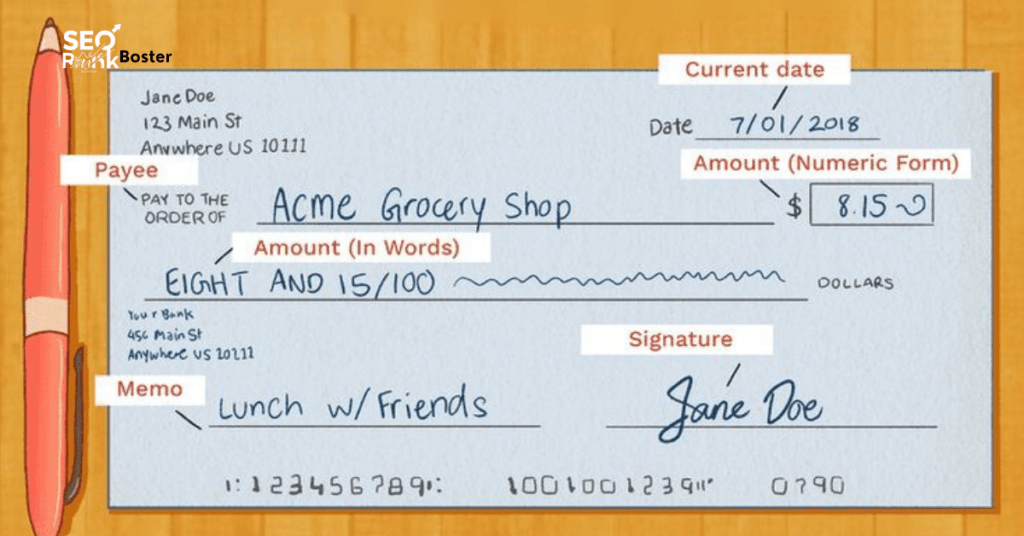

ToggleWriting a check might seem like a simple task, but for many people, it can be confusing if they don’t do it regularly. Whether you’re paying rent, making a purchase, or handling other financial matters, knowing how to properly fill out a check is essential. In this guide, we’ll walk you through how to write a check, step-by-step, ensuring that your payment is correctly processed. Understanding these steps can help you avoid mistakes and ensure your payments are made smoothly.

Why Writing a Check is Still Important

Even in the digital age, checks remain an important payment method for specific transactions. Some landlords, small businesses, and contractors may prefer checks over electronic transfers. Moreover, checks provide a physical record of your payment, which can be helpful for bookkeeping or proof of payment. Learning how to write a check accurately is a valuable skill in managing your finances.

1. Date the Check

The first step in writing a check is to fill in the date in the top right corner. This should be the date you’re writing the check, and it’s crucial because it indicates when the check was issued. You can write the date in different formats, such as “October 17, 2024” or “10/17/2024,” but be consistent with how you write it.

Make sure the date is current and accurate, as postdating checks (writing a future date) can sometimes cause issues if the recipient tries to cash it before that date.

2. Write the Payee’s Name

On the line that says “Pay to the Order of,” write the name of the individual or company who will receive the payment. Ensure you spell their name correctly, as any misspelling or abbreviation could cause the bank to reject the check. If you’re unsure of the official name of a business or payee, confirm the details before filling out the check.

Important Tip:

If you are writing a check to a person, use their full legal name, and if you’re writing a check to a business, write their full business name, not a nickname or short form.

3. Enter the Amount in Numbers

In the small box to the right, enter the amount of the check in numeric form. For example, if you are paying $150.75, you will write “150.75.” Be sure to write the amount and avoid any ambiguous writing, as this is the official amount the bank will process.

Common Mistake:

Avoid leaving too much space before or after the amount in the box. This reduces the risk of someone altering the check.

4. Write the Amount in Words

Below the payee’s name, you’ll see a blank line with the word “Dollars” at the end. Here, you need to write the check amount in words. This is an important step because if there’s a discrepancy between the numerical amount and the written amount, the written amount is what the bank will honor.

For example, if your check is for $150.75, you would write “One hundred fifty dollars and 75/100.” If the amount is a whole number, such as $150, you would write “One hundred fifty dollars and 00/100.”

Note:

Always write fractions for the cents portion, and draw a line after the amount to fill any blank space left on the line. This helps prevent anyone from altering the check amount.

5. Fill Out the Memo Line (Optional)

The memo line is an optional part of the check, located at the bottom left corner. Here, you can note the reason for the payment or any other important details, such as “January Rent” or “Invoice #12345”. This is useful for both you and the recipient to keep track of the purpose of the check, especially for personal bookkeeping or accounting.

Best Practice:

Even though it’s optional, filling out the memo line can help keep your financial records organized, particularly when you’re managing multiple payments.

6. Sign the Check

Finally, you’ll need to sign the check on the line at the bottom right corner. This is one of the most important parts of the check, as it authorizes the bank to process the payment. Without your signature, the check is invalid.

Make sure your signature matches the one the bank has on file for your account. If the signature is too different, the bank may reject the check.

7. Double-Check Everything

Before you hand over or mail the check, take a moment to review all the information. Make sure the payee’s name is spelled correctly, the amount is accurate, and your signature is in place. Any errors could lead to the check being rejected or delayed.

Why Accuracy Matters:

Banks are very specific about checks because they are legal financial instruments. Any errors could result in delays or the need to reissue the check, which can be inconvenient for both you and the payee.

How to Avoid Common Check Writing Mistakes

To ensure that your check is processed smoothly, here are a few common mistakes to avoid:

- Postdating the Check: Writing a future date on a check could cause issues if the recipient tries to cash it before that date.

- Misspelling the Payee’s Name: Always double-check the spelling of the payee’s name to avoid complications.

- Writing the Wrong Amount: Make sure the numerical and written amounts match exactly.

- Forgetting to Sign the Check: A check without a signature is invalid and cannot be processed.

The Advantages of Writing Checks

Although digital payments are more common these days, there are still several advantages to using checks:

- Proof of Payment: Checks provide a clear paper trail, making it easier to track your payments and avoid disputes.

- No Electronic Fees: When you write a check, you typically avoid the electronic fees associated with credit card payments or bank transfers.

- More Control: Writing a check gives you more control over when and how much you’re paying. You can also stop payment on a check if necessary.

When Should You Write a Check?

While many people prefer electronic payments, checks are still useful in certain situations, such as:

- Rent Payments: Some landlords still prefer checks for rent.

- Paying Contractors or Small Businesses: Certain small businesses may prefer checks over credit card transactions.

- Gifts or Donations: Writing a check for a personal gift or charitable donation adds a personal touch that electronic payments may lack.

Conclusion

Writing a check may seem outdated, but it’s still a valuable skill in today’s financial world. By following the steps outlined above, you can ensure that your check is filled out correctly and avoid any common mistakes. Remember, attention to detail is key when it comes to writing checks, as even small errors can cause significant issues.